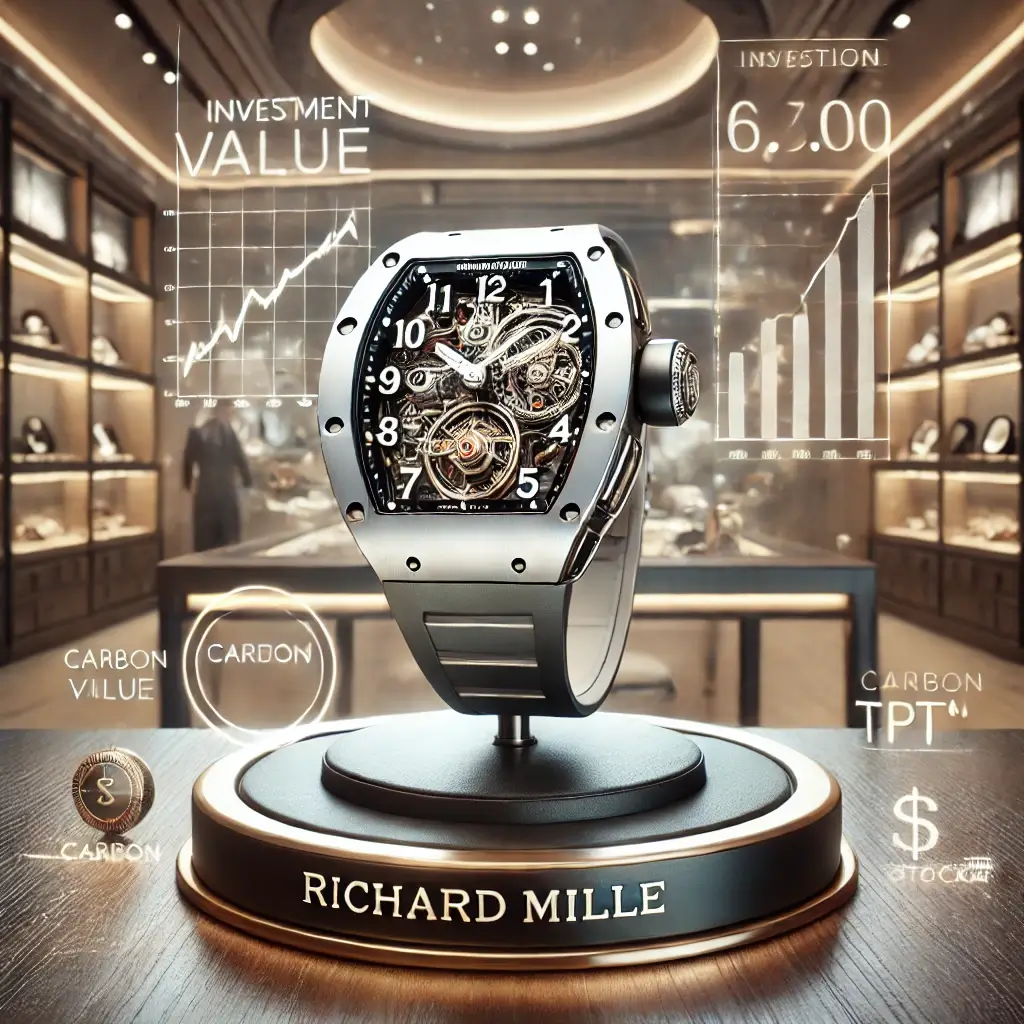

Engineering Value: Richard Mille’s Innovative Materials and Exclusive Distribution Strategy

The Luxury Investment Phenomenon

Richard Mille is more than just a watch brand; it is a testament to innovation, exclusivity, and high-stakes investment. With its bold designs and cutting-edge engineering, the brand has captivated collectors and investors alike. Since its establishment, Richard Mille has distinguished itself with limited production runs, unique material applications, and an audacious approach to luxury. These attributes, combined with the brand’s strategic positioning in the market, have propelled its timepieces into the realm of alternative investments. By 2024, rare models have seen appreciation rates as high as 320%, while even standard models retain over 85% of their retail value, offering investors both financial returns and the allure of unparalleled craftsmanship.

Engineering Excellence and Cultural Significance

What sets Richard Mille apart is its relentless focus on pushing boundaries. Utilizing materials like Carbon TPT®, Graph TPT®, and titanium, the brand has redefined watchmaking standards. Beyond their technical merits, these timepieces are cultural icons, often seen on the wrists of global celebrities and athletes. This dual appeal—as engineering marvels and symbols of status—has positioned Richard Mille as a frontrunner in the luxury watch market.

Market Insights and Investment Performance

Market Insights and Current TrendsRichard Mille’s rise as an investment powerhouse is supported by its unique market strategies and technological innovations. Limited-edition pieces, such as the RM 052 Skull and RM 27-04 Tourbillon, have garnered significant attention, with the former achieving a 320% value increase and the latter fetching premiums exceeding 250% of its retail price at major auctions like those hosted by Christie’s and Phillips (Phillips Watch Market Report 2024).

Strategic Collaborations and Material Innovation

The brand’s collaborations with elite athletes, including Rafael Nadal, and its focus on advanced materials contribute to its investment appeal. These collaborations are not mere marketing stunts; they reflect the integration of performance and artistry. For instance, the RM 035 Rafael Nadal, designed to withstand the rigors of professional tennis, has seen exceptional value retention and market demand.

Distribution Strategy and Market Dynamics

From a distribution perspective, Richard Mille’s boutique-only approach and exclusivity tactics, such as regional allocations and VIP client preferences, create scarcity that drives demand. According to the Morgan Stanley Luxury Analysis 2023, this scarcity model ensures that each release garners immediate attention from both collectors and investors, further solidifying the brand’s position as a market leader.

Investment Entry Strategies

Strategies for Investors: Navigating the Richard Mille EcosystemInvesting in Richard Mille requires more than financial capital; it demands market insight and strategic positioning. For new entrants, establishing connections with authorized boutiques is crucial for securing limited-edition releases. Secondary markets, including trusted dealer networks and auction platforms, also present opportunities, though authentication and provenance checks are imperative to mitigate risks.

Portfolio Optimization for Maximum Returns

Identifying high-growth segments within the Richard Mille portfolio is key. Limited-edition pieces, especially those tied to sports collaborations or featuring advanced tourbillon mechanisms, are often the most lucrative. For example, the RM 27-04 Tourbillon, a testament to both engineering and artistry, has emerged as a collector’s dream. Reports from the Watch Collection Investment Fund indicate that early acquisition of such models often results in significant long-term gains.

Value Preservation and Maintenance

Maintenance and insurance also play critical roles in preserving value. Richard Mille watches, despite their durability, require expert servicing to maintain their intricate mechanisms. Proper storage, complete documentation, and comprehensive insurance are essential considerations for any investor.

The Future of Luxury Watch Investments

ConclusionRichard Mille represents the zenith of luxury watchmaking and investment potential. Its combination of innovation, exclusivity, and cultural cachet makes it a standout in the world of high-value assets. With a consistent track record of appreciation and a growing presence in major auction houses, the brand continues to redefine what it means to invest in luxury. For those with the vision to navigate this market, Richard Mille offers not just financial rewards but the intangible prestige of owning a piece of modern horological history.

Authoritative Sources

References

Christie’s Auction Results 2023

Phillips Watch Market Report 2024

Morgan Stanley Luxury Analysis 2023

Luxury Watch Market Index 2024

Watch Collection Investment Fund